IG - Morning thoughts and opening prices: 20 June 2013

Good morning,

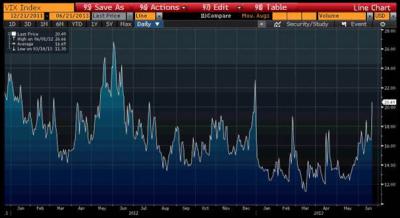

The carnage in global markets continued in US trade as panic set in following the Feds comments. With most economists now of the opinion that the Fed will start tapering as early as September by $20 billion, the Bernanke put seems to be swiftly waning. Markets had been pricing in the possibility of tapering for a while but clearly the magnitude of the impact was underestimated. Investors were always going to have an adverse reaction after having enjoyed a free ride, particularly in US equities, over the past year. The bad news just simply compounded yesterday with China and Greece concerns adding to the fear factor and the VIX spiking through 20.

Click for big version.

Asia took another leg lower on the back of the disappointing PMI reading and spiking interbank rates. In Europe, a headline suggesting the IMF is preparing to halt Greece payments unless a €3-€4 billion shortfall is plugged and we suspect this will gather momentum today. German flash manufacturing PMI disappointed (48.7 versus 49.9 expected) but was neutralised by some positive PMIs for other countries in the region.

Economic data released in US trade including the Philly Fed manufacturing index (strongest headline print since April 2011) and existing home sales also came in well ahead of expectations, supporting the notion that the US recovery is on track. The dollar index spiked through 82 and this strength in the USD caused a significant selloff in various asset classes.

Starting with the moves in the FX

space, AUD/USD traded sub $0.92 to lows around $0.916 and

remains sidelined at $0.92. Any rallies are likely to

continue being used as an opportunity to sell. Japan

continues to be the beneficiary out of all this carnage as

USD/JPY spiked to 98.29 before pulling back below 98.

However, this is yet to feed through to Nikkei futures as we

are currently calling Japan down 1.7%. BoJ Gov Kuroda will

be on the wires today and given all the volatility we’ve

seen this week, he’s likely to throw in some

curlers.

(US dollar index)

Click for big version.

Ahead of the open we are calling the Aussie market down 2% at 4664. Should we open at that level, the local market would be down 2.7% for the week and in an extremely vulnerable position. Last week’s low was 4659 and that’ll be the level to look out for today ahead of the year’s breakeven level of 4649. It’s going to be carnage in the gold names today after the precious metal was savaged overnight, dropping below 1,300 to a low of 1,277. Once technical support at 1,320 was broken, gold’s losses simply accelerated. Rallies back to 1,320 would be an opportunity to sell. This move has really spooked investors out there and is not good news at all for Newcrest which is already struggling on the back of disclosure and operational issues. Iron ore ticked another 0.5% higher but this is unlikely to make a difference in a macro driven market. BHP’s ADR is pointing to a 1.4% drop to 31.70. The only thing that can save the equities today would be bargain hunting as we approach the breakeven for the year.

| Market | Price at 6:00am AEST | Change Since Australian Market Close | Percentage Change |

| AUD/USD | 0.9194 | -0.0052 | -0.56% |

| USD/JPY | 97.4450 | 0.4100 | 0.42% |

| ASX (cash) | 4664 | -94 | -1.98% |

| US DOW (cash) | 14772 | -289 | -1.92% |

| US S&P (cash) | 1587.4 | -32.4 | -2.00% |

| UK FTSE (cash) | 6126 | -134 | -2.15% |

| German DAX (cash) | 7899 | -165 | -2.04% |

| Japan 225 (cash) | 12795 | -220 | -1.69% |

| Rio Tinto Plc (London) | 27.50 | -0.50 | -1.80% |

| BHP Billiton Plc (London) | 17.64 | -0.48 | -2.68% |

| BHP Billiton Ltd. ADR (US) (AUD) | 31.70 | -0.45 | -1.41% |

| US Light Crude Oil (June) | 94.96 | -1.82 | -1.88% |

| Gold (spot) | 1280.65 | -63.8 | -4.75% |

| Aluminium (London) | 1802 | -17 | -0.91% |

| Copper (London) | 6774 | -94 | -1.37% |

| Nickel (London) | 13737 | -128 | -0.92% |

| Zinc (London) | 1834 | -5 | -0.29% |

| Iron Ore | 120.60 | 0.6 | 0.50% |

IG provides round-the-clock CFD trading on currencies, indices and commodities. The levels quoted in this email are the latest tradeable price for each market. The net change for each market is referenced from the corresponding tradeable level at yesterday’s close of the ASX. These levels are specifically tailored for the Australian trader and take into account the 24hr nature of global markets.

Please contact IG if you require market commentary or the latest dealing price.

ENDS

Hugh Grant: How To Reduce Network Bottlenecks

Hugh Grant: How To Reduce Network Bottlenecks Dominion Road Business Association: Auckland Transport's 'Bus To The Mall' Campaign: A Misuse Of Public Funds And A Blow To Local Businesses

Dominion Road Business Association: Auckland Transport's 'Bus To The Mall' Campaign: A Misuse Of Public Funds And A Blow To Local Businesses Parrot Analytics: A Very Parrot Analytics Christmas, 2024 Edition

Parrot Analytics: A Very Parrot Analytics Christmas, 2024 Edition Financial Markets Authority: Individual Pleads Guilty To Insider Trading Charges

Financial Markets Authority: Individual Pleads Guilty To Insider Trading Charges Great Journeys New Zealand: Travel Down Memory Lane With The Return Of The Southerner

Great Journeys New Zealand: Travel Down Memory Lane With The Return Of The Southerner WorkSafe NZ: Overhead Power Lines Spark Safety Call

WorkSafe NZ: Overhead Power Lines Spark Safety Call